Navigating UK Minimum Wage: A Comprehensive Guide

Source: Playroll

In the UK, the National Living Wage rate and the Apprentice rate saw the largest increases for 16-20 year olds in history, with a 21% rise for 16-17 year olds and a 15% increase for 18-20 year olds. These changes aim to narrow the gap between youth rates and the National Living Wage, addressing disparities in living standards and cost of living, especially in regions like London.

Recent Changes and Trends to the UK minimum wage

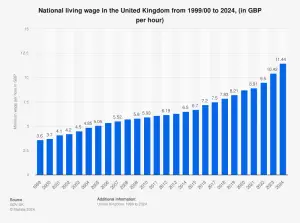

The UK’s minimum wage landscape is undergoing significant shifts, reflective of long-term economic strategies and the goal of equitable compensation. As of April 2024, the National Living Wage (NLW) increased to £11.44 per hour, marking a substantial 10% increase in cash terms. This adjustment represents the third largest annual increase in real terms since the inception of the NLW.

These changes are part of a broader commitment by the UK government to ensure fair compensation, aligning minimum wage rates with inflation and living costs. The 2024 increase is notable as it sets the NLW at approximately 30% higher than the adult minimum wage in 2015, the highest ever in real terms.

Understanding these changes helps businesses ensure compliance and supports effective workforce management. The government’s approach balances supporting workers while considering the economic viability of businesses, attempting to strike a balance as companies navigate adjustments amidst recovering economic conditions post-financial crisis.

Minimum Wage UK: Definition and Importance

The UK minimum wage than a legal benchmark—it’s a foundation that fosters a culture of respect and value for employees across sectors. Here, we peel back what this term really means and explore its impact beyond the legal realm.

For workers, the minimum wage ensures a base level of financial stability, setting a floor for their quality of life.

Employers, on the other hand, must deftly balance fair compensation with their business’s financial health—a task that’s anything but straightforward.

A Look at the Evolution and Current Status

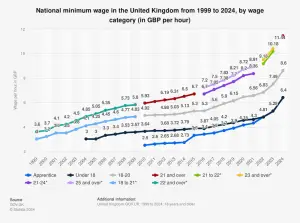

Since its 1999 introduction, the UK’s minimum wage structure has evolved, initially categorizing wages by age and expanding over the years.

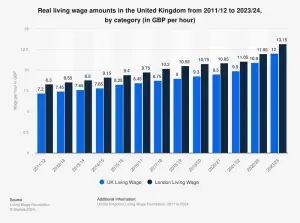

Historically, it began with two age groups, expanded to include under 18s in 2004, and adjusted several times up to 2016. In 2024, the structure consolidates back to four main categories. In addition to these statutory minimums, a higher voluntary real living wage provides £12 per hour nationally and £13.15 in London for 2023/24.

Recent trends show a promising shift: as of January 2024, wages are finally outpacing inflation, with regular weekly earnings growing by 6.1%, significantly above the CPI inflation rate of 4% that month. This recovery comes after a tough period where wages lagged behind inflation, dramatically impacting the UK’s cost of living and affecting nearly every household.

The voluntarily paid living wage in the United Kingdom for 2023/24 is twelve British pounds per hour, with this rising to 13.15 pounds per hour for workers in London. (Source: Statista)

Current Minimum Wage UK Rates

Understanding the UK’s New Minimum Wage Structure Effective April 2024

As we move into the 2024/25 financial year, the UK has revised its minimum wage rates. The most notable change is in the National Living Wage (NLW), which now extends to workers aged 21 and over, significantly broadening its scope. This rate has seen a substantial increase from £10.42 to £11.44 per hour.

Here’s the updated breakdown of the UK minimum wage categories from April 2024:

| Category | Age Range | Wage | Notes |

| National Living Wage | 21 years and older | £11.44 per hour | Expanded from previous years |

| Young Workers | 18-20 years old | £8.60 per hour | Support for younger workers |

| Under 18 | Under 18 years old | £6.40 per hour | Support for the youngest workers |

| Apprentices | Under 19 or first year | £4.30 per hour | Standard rate after first year |

Categories of Workers (Apprentices, Age Groups)

The UK minimum wage varies for different worker types, making it important for both employers and employees to understand these distinctions for compliance and fair compensation.

Workers must be at least school-leaving age to receive the National Minimum Wage and 23 or over for the National Living Wage. This includes part-time, casual labourers, agency workers, apprentices, and others. Any contract offering pay below these rates is not legally binding.

UK Minimum Wage Calculations

Correct minimum wage calculations depend on distinguishing between hourly rates and annual salaries. Payments must align with NMW and NLW standards. Regular bonuses count towards the minimum wage, but one-time or irregular bonuses do not.

Additional Information on Wage and Eligibility

Employers should verify if internship and work placement participants are eligible for minimum wage. Specific groups like self-employed individuals and company directors do not qualify for NMW or NLW. Ensure all workers receive appropriate compensation according to their legal rights.

Understanding Wage Trends and Living Standards

From mid-2021 to late 2023, wage growth in the UK did not match rising inflation, severely impacting disposable income. Despite a late-year decrease in inflation, the economic effects were significant. Employers need to consider these conditions when setting compensation to ensure employee financial stability.

Source: Statista, National Minimum Wage and National Living Wage rates

UK Minimum Wage Challenges for Employers

Cost Implications

In the UK, there is a national minimum wage that employers are required to adhere to. The rates can vary depending on the age of the worker and whether they are an apprentice. Employers in the UK may face financial challenges in complying with these regulations, especially if they operate in industries with thin profit margins or rely on low-wage labour. However, it’s important for employers to recognise the long-term benefits of having a motivated and satisfied workforce, which can contribute to increased productivity and employee retention.

Workforce Productivity and Morale

Maintaining a balance between cost control and workforce morale is a concern for employers globally, including those in the UK. In the UK, where labour laws and workers’ rights are well-defined, employers need to be mindful of how their decisions and policies impact employee morale. Effective communication and empathy are crucial in navigating this balance, as dissatisfaction among the workforce can lead to decreased productivity and potentially even legal issues.

Addressing Wage Disparities

Wage disparities within an organisation are a concern in the UK as they can contribute to employee discontent. The UK has laws and regulations aimed at promoting fairness and equality in the workplace. Employers need to be proactive in addressing wage disparities to create a work environment that is perceived as fair and inclusive.

Contact

If you have found this article useful and would like to receive further information or if you would like to discuss your recruitment needs with one of our consultants contact us on hr@jarell.co.uk